When you’re approved for Supplemental Security Income (SSI), the Social Security Administration (SSA) decides how much you’ll get each month by looking at a few important things.

These include how much money you make, where you live, and the federal benefit rate (FBR), which is the highest amount you can receive in SSI payments.

The SSA also checks if your state offers extra money on top of the federal amount. Of course, you will need to wait for a certain period before you can expect the pay.

Knowing how these factors work together can help you understand how much SSI you’ll get and if there could be any changes to your payments.

The SSI Payment Formula

The Social Security Administration (SSA) calculates your federal SSI benefit by using a simple formula.

- For individuals, the maximum is $733.

- For couples, the maximum is $1,100.

Unearned income includes things like Social Security:

- Benefits

- Pensions

- Gifts

Subtract Your Countable Earned Income

Earned income includes any wages or money you receive from working.

However, when calculating your Supplemental Security Income (SSI) payment, the Social Security Administration (SSA) does not count all of your earned income.

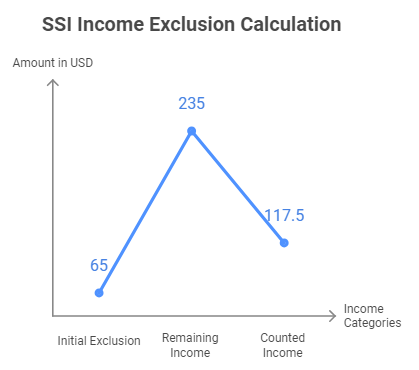

Instead, they follow a specific process to reduce the impact of your earnings on your SSI benefits:

The first $65 of your earned income each month is completely excluded from the calculation. This means that you get to keep this portion of your earnings without it affecting your SSI benefit.

After excluding the initial $65, the SSA only counts half of the remaining earned income.

- First, subtract $65 from $300, which leaves $235.

- Then, the SSA only counts half of the remaining $235, which is $117.50.

The SSA then subtracts this counted portion of your income (in this case, $117.50) from the maximum federal benefit amount to determine how much SSI you will receive.

This formula allows you to work and still receive some SSI benefits, as the SSA only considers a portion of your earned income when calculating your monthly payment.

By excluding a significant part of your wages, the SSA encourages people with disabilities or limited income to seek employment without losing their benefits entirely.

After subtracting your countable income from the maximum federal benefit amount, the leftover amount is your SSI payment. The formula helps calculate the exact SSI benefit you’ll receive each month, based on your income sources.

State Supplements

In addition to the federal SSI benefit, many states offer a supplementary benefit to individuals who qualify for SSI. These state supplements are designed to provide additional financial support to those in need.

Here’s how they work:

Who Qualifies for State Supplements?

Individuals who qualify for federal SSI often receive state supplements automatically.

In some cases, individuals who don’t qualify for SSI due to income or resources exceeding the federal limit may still qualify for the state supplement, as some states have higher income or asset limits.

State-Administered vs. Federally Administered Supplements

Some states administer their supplement programs. If this is the case, you may need to apply directly to the state or its relevant agency to receive the additional benefit.

Other states delegate the administration of their supplemental benefits to the Social Security Administration (SSA).

In these states, the SSA handles both federal and state payments, meaning you do not need to apply separately for the state benefit.

How to Apply for State Supplements

If you live in a state that manages its supplement program, the SSA will direct you to the appropriate state agency during your SSI application process.

You’ll need to apply separately with the state to receive the supplementary benefit.

If your state’s supplement is managed by the SSA, you don’t need to take any additional steps, as the Social Security Administration will automatically handle your eligibility and payment.

Each state sets its own eligibility rules and payment amounts for state supplements, so the additional benefit can vary widely depending on where you live.

When Income is Counted for SSI

Once your SSI is approved, your ongoing financial eligibility is reviewed on a month-by-month basis. This means your eligibility for benefits can change frequently.

For instance, you might be eligible one month, ineligible the next, and then eligible again in the following month, depending on your income and other factors.

Initial Three Months of Eligibility

During the first three months of eligibility, the Social Security Administration (SSA) calculates your SSI benefits based on your income received in the same month.

Any non-recurring income, like a one-time payment or gift, will only be counted in the month you receive it. This ensures that one-time sources of income don’t unfairly affect your benefits over multiple months.

Ongoing Monthly Calculations

After the initial three months, your SSI payments are based on the income you received two months prior. This system is referred to as “retrospective monthly accounting.”

- If you became eligible for SSI in March 2016, your June payment will be determined by the income you received in April.

- Similarly, your July payment will be based on your income in May, and this pattern continues.

This system emphasizes the importance of accurately reporting changes in income. You should report any changes by the 10th of the month following the change.

Timely reporting helps to minimize the risk of either underpayment, where you might receive less than you should, or overpayments, which you may have to repay later.

What Happens If Your Eligibility is Interrupted?

If your SSI eligibility is interrupted for any reason, the calculation process resets when you become eligible again.

The first three months of renewed eligibility are treated like a new claim.

During these months, your SSI benefits are calculated based on the income you receive that same month, just as in the initial period of eligibility.

Changes in Marital Status

- If an adult SSI recipient gets married or divorced, their benefits will be recalculated using the same three-month reset process.

- If a child receiving SSI has a change in their parent’s marital status, or if the child leaves the parent’s home, the recalculation will also follow this same convention.

Understanding how income is counted and how payments are calculated month-by-month is crucial to managing your SSI benefits and ensuring you receive the correct amount each month.